Homebuyers decry move, say it will put an extra burden on their pockets. Government coffers set to swell, thanks to the hike.

Registry of properties in Gurugram is set to get dearer as the Haryana government has decided to hike circle rates by up to 30 percent across the district.

Real estate experts say that though the hike in circle rates will not have an instant impact on prices in the premium segment, it will make registry of properties costly. Homebuyers say that the hike in circle rates will put extra burden on the pocket of the common public as they will have to pay higher stamp duty in line with the revised circle rates.

Circle rate is the minimum value set by the government for sale and transfer of a house, plot, flat or commercial establishment. The government levies a stamp duty on transfer of properties, which is one of the major sources of revenue for the state government.

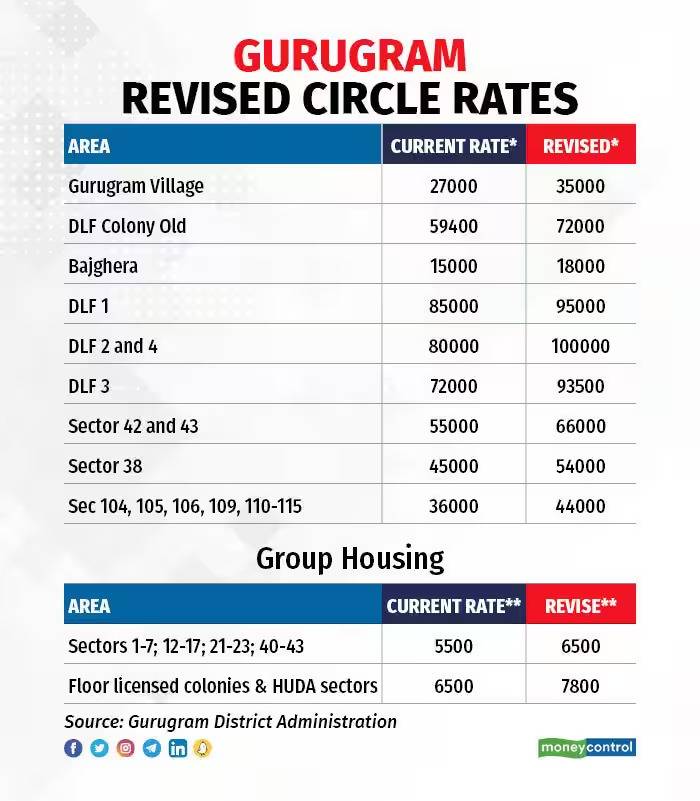

According to officials of the district administration, circle rates have been hiked between 10 percent and 30 percent across the district, depending on the area. Circle rates in commercial areas have also been increased by about 10 percent.

The officials said that circle rates of sectors located near Golf Course Road, Dwarka Expressway and Southern Peripheral Road have been increased by up to 30 percent, while in some areas such as sector 26 and 26A, the hike is around 11 percent.

An official of the district administration said that the revision in circle rates is a regular exercise carried out every year. The revision is an important exercise to reduce the gap between circle rates and market rates so as to maintain stability.

“The revised circle rates will be effective April 1. Registries will now be executed on these revised circle rates. The money realised from the stamp duty on the basis of the revised circle rates will be utilised for the development of the tehsil and the district. It is public money and will be used on public welfare works,” the official said, requesting anonymity.

All the tehsils in the district, which include Gurugram, Sohna, Pataudi, Farukhnagar, Badshahpur, Manesar, Wazirabad, Harsaru and Kadipur, have witnessed a 10 percent to 30 percent increase in their circle rates.

What do homebuyers have to say?

Homebuyers have opposed the move and said that a hike in circle rates will put extra burden on their pockets.

Mrityunjay Singh, a resident of sector 47 in Gurugram, said that the move is not in the interests of homebuyers.

“Land rates are already high in the region and a hike in circle rates will ensure that people have to pay more money while registering or transferring their properties. This will be an extra burden on the common public,” Tiwari told Moneycontrol.

Sunaina Tiwari, another homebuyer and a resident of sector 43, added, “Circle rates in my area have been increased by around 20 percent, which will translate into more stamp duty for prospective buyers to pay. The common public is already troubled with skyrocketing inflation and this hike in circle rates will be another blow to prospective buyers.”

Real Estate experts’ take

Real Estate experts had mixed responses to the hike in circle rates.

Rohit Papneja, a real estate broker, said that the hike would not have an immediate impact on prices in the premium segment but would make registry of properties dearer.

“In many areas market rates for premium properties are already higher than the revised circle rates and properties are being sold on those market rates, so there will not be much of an impact in this segment. However, people will have to shell out more money as stamp duty will now be collected on the hiked circle rate. This may impact affordable segment housing to an extent,” Papneja said.

Vivek Singhal, CEO of Smartworld Developers, said that the recent surge in circle rates in Gurugram is a move in the right direction by the government.

“The reduction in the gap between the market value and circle rate will further boost the primary real estate market, enhance transparency and promote organised development in the real estate industry. We are confident that the recent surge in circle rates will not discourage potential buyers from investing in Gurugram’s real estate market, which has shown tremendous growth potential over the years,” Singhal said.

However, Santosh Agarwal, CFO and Executive Director, Alpha Corp, said that a higher circle rate correlates with a higher registration cost, which translates to a higher acquisition cost and has an impact on the property’s transactability.

“We believe that increasing circle rates in the current scenario would be impractical. Due to the increase in circle rates, buyers may not invest in any property in the short term and may like to hold off on a decision for now, which will affect the realty market as a whole. Any decision to raise the circle rate undermines the recovery process and has a detrimental influence on the real estate sector,” Agarwal said.

The Haryana government’s proactive decision to enhance the circle rate in Haryana, especially Gurugram, is a welcome move and very much required, considering the recent appreciation in property prices, said Amit Goyal, CEO, India Sotheby’s International Realty.

“However, we believe that all state governments should consider alternative long-term solutions to reduce dependence on circle rates,” Goyal added. “We recommend that all property transaction values should be made available online on the revenue department’s website. This way, a simple search using any pin code would immediately display the latest 10 transactions, providing a clear picture of market demand and supply dynamics. Such transparency measures would also highlight any outliers, making it challenging to register properties at prices lower than the transaction price.”

Mohit Jain, Managing Director, Krisumi Corporation, said that the real estate market in Gurugram has experienced substantial growth in demand and price due to various infrastructure developments and enhanced connectivity. The rise in circle rates was consistent with the increasing property prices and served to confirm the appreciation in value, he added.

Source : Money Control