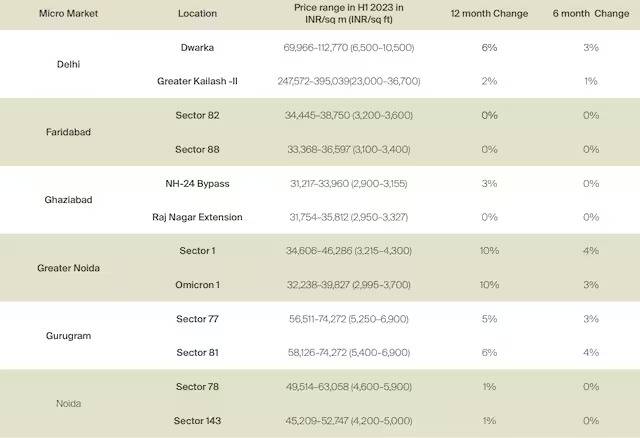

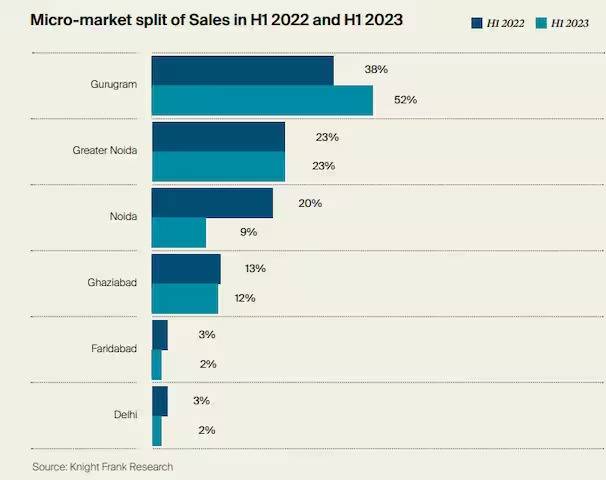

Residential sales in Delhi-NCR touched a 10-year high in the first half of 2023 at 30,114 units, of which Gurugram accounted for more than half the units sold with a 52% share, according to a report by real estate consultancy firm Knight Frank India.

Noida and Greater Noida cumulatively accounted for a 32 per cent share of the total pie. Ghaziabad accounted for 12% share whereas Delhi and Faridabad accounted for 2% share each.

The 2023 residential sales volume represents a 3 per cent annual growth over the first half of 2022.

Due to a lack of ready to move in inventory by credible developers, any new inventory introduced by such developers has found takers in the market as it comes out of the shadow of the pandemic. Post pandemic, buyers’ confidence in timely delivery of new projects has been reinstated to some extent. These factors have contributed to making H1 2023 the strongest half yearly period since H1 2013,” said Balbirsingh Khalsa, Executive Director at Knight Frank

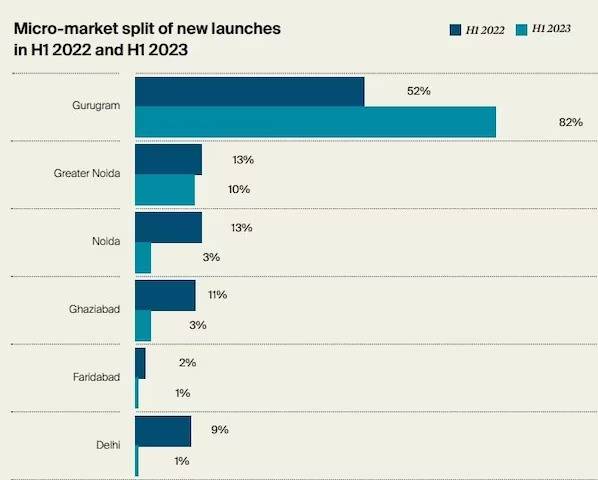

“In a thriving NCR market, witnessing a remarkable 10-year high in home sales, the surging demand for flats priced above Rs 1 crore underscores the immense growth potential and profitability within the real estate sector. This robust momentum serves as a catalyst for developers to explore innovative designs, embrace sustainable practices, and push the boundaries of development,” said Kunal Rishi, COO, Paras Buildtech.

“We are thrilled to witness the robust surge in home sales in the NCR, reaching a remarkable 10-year high. It is a testament to the resilience and vibrancy of the real estate market in this region. The escalating demand for flats valued upwards of Rs 1 crore further emphasizes the evolving aspirations and purchasing capacity of buyers in NCR” said Vivek Singhal, CEO, Smartworld Developers.

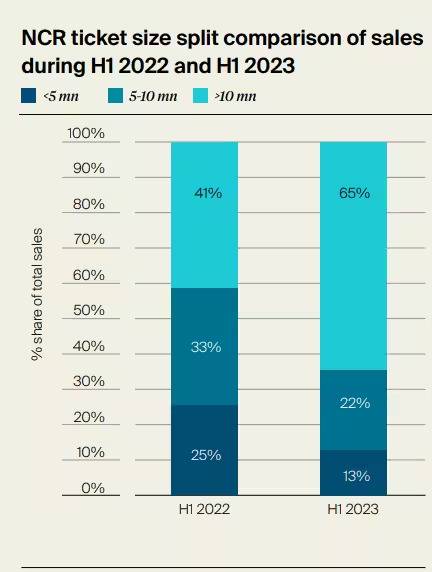

Residential price movement in key areas