Over the last couple of years, Indian consumers and NRIs have re-posted their confidence in real estate after a brief hiatus during the pandemic. Contrary to most reports, the investment flows and demand for quality real estate projects continued to grow post the pandemic. This black swan event which acted as a catalyst for the sector, also altered the way customers perceived their need for luxury real estate and spacious homes. People began to perceive spacious, quality construction homes as a need rather than a luxury.

The current demand scenario

Housing demand remained strong in H1CY22. The share of sales in the Rs 1 crore and above ticket size in overall home sales grew significantly to 25% in H122 compared to 20% a year ago. This is largely due to homebuyers’ need to upgrade to larger living spaces with better amenities. Though the pandemic led to a disruption in the income earned by many, there was a certain section, primarily the higher income earning segment that did not see much impact.

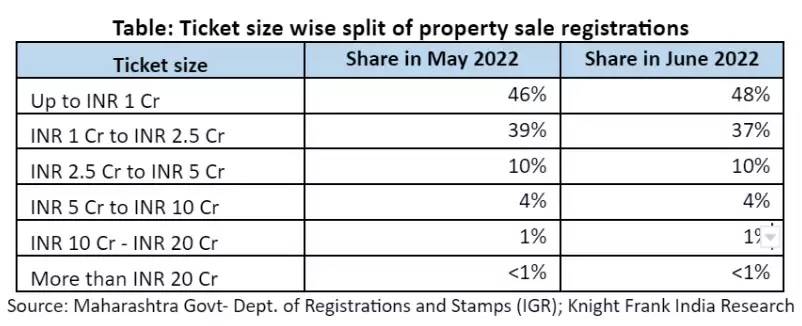

Going by the property registration data for the month of June 2022, a large part of home sales were in the range of Rs 1-2.5 crore. The western and the central suburbs accounted for nearly 86% of the total market share indicating the prominence of these well-established areas given the development of infrastructure projects that will further enhance connectivity.

Table: Ticket size-wise split of property sale registrations

Affordability

The affordability factor was at a multi-year best till a few months ago when the RBI hiked interest rates by 90 bps, thereby causing an average 2% decrease in the Affordability Index level across markets and a 6.97% increase in the EMI load. As per the Knight Frank Affordability Index, an increase of 150 bps in the home loan rate will result in an 11.73% increase in the EMI load for the homebuyer and an effective 3.38% decrease in affordability. This is something that needs to be closely studied in the coming months.

Pricing power

What is encouraging is that we witnessed a growth in sales volumes during H1 2022 as well as price growth across all markets. Prices have grown in YoY terms across all markets for the first time since H2 of the year 2015. Prices rose in the range of 3-9% YoY across markets with prices in the larger markets of Mumbai, NCR, and Bengaluru moving at the top of this growth band at 9%, 7%, and 9% YoY respectively. Often, the pricing power indicates a bullish sentiment in the market.

INR depreciation and the fund flows from NRIs

The INR depreciation also helps with fund flows from the NRIs. The fall in the rupee makes NRIs investing in Indian real estate more affordable. The Indian rupee hit an all-time low during the first wave of the pandemic, post that it has been making new lows. As per a report by 360 Realtors, NRI real estate investment totaled $13.1 billion last year and is projected to increase by 12% this year.

Source : TOI