Golf Course Road is a well-developed luxury micro market in Gurgaon which has been in high demand from the HNIs and luxury buyers alike.

“The investors are back, and DLF knows how to ace this game,” says 35-year-old Kapil, a property dealer in Gurugram (previously known as Gurgaon). Earlier this year, real estate major DLF made headlines when it managed to sell out all 1,137 units — priced at Rs 7 crore and above — for over Rs 8,000 crore within just about three days of launch at Golf Course Extension Road. The majority of the buyers comprised NRIs, corporate executives, businessmen, entrepreneurs, start-up founders, lawyers, doctors, and the queue to purchase through secondary sales is even longer, said industry players in the know.

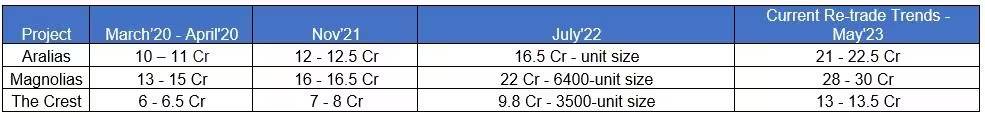

As the realty giant prepares the launch of its next project, termed “Magnolia 2 or Crest 2” on Golf Course Road, it has ensured that the most sought-after residential pin code in all of Delhi NCR is now up over 42 per cent in the last one year.

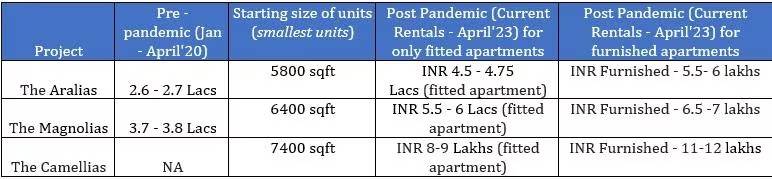

After the pandemic, and with the return of the NRI investors and expats, not only have rentals in Gurugram’s Golf Course Road increased 14% year-on-year, those of luxury residences such as The Magnolias, The Aralias, The Camellias and The Crest have seen doubling of rentals since 2020.

For instance, rentals at Aralias, the first luxury condo by DLF on Golf Course Road, have increased from Rs 2.5 lakh for a 5,800 square feet apartment pre-pandemic to Rs 5.5 lakh. Similarly, DLF’s second major luxury project adjacent to Aralias- the Magnolias- has seen rentals rise from Rs 3.7 lakh for a 6,400 square feet apartment to Rs 6 lakh today for a fitted apartment.

The most premium of these luxury condos is the Camellias, which looks nothing short of a five-star resort, and rentals range between Rs 8-9 lakh for a 7,400 square feet apartment. The demand again is from corporate honchos, wealthy businessmen and NRIs looking to return and settle in India.

Rental appreciation of the DLF Super Luxury properties at Golf Links, Golf Course Road.

While DLF properties on Golf Links have seen a 100 percent appreciation in two years, other builders too on Golf Course Road are riding the wave. Properties like Bel Monte and Exotica have not seen a similar hike, they have also gone up in value. From Rs 2.8-3 crore in 2020, they are now not less than Rs 4.8-5 crore,” according to market research by Business Standard.

So what is fuelling this buyer interest at such jaw-dropping prices?

There is no new supply, but demand is at a 10-year high

“The capital appreciation in Delhi NCR was observed at 40 per cent on a year-on-year (YoY) basis at the end of 2022 compared to 2021. The rentals are following the same trend and increasing in the same proportion owing to limited move-in inventory but a decade-high demand,” said Samir Jasuja, Founder and CEO, PropEquity.

In the case of Gurugram, the ready to move in inventory was only 1,433 units with a value of Rs 2,885 crore. In comparison, the under-construction inventory is around 9,912 units valued at Rs 23,104 cr, which shows data from PropEquity.

This shows a significant crunch in ready to move in properties which are high in demand, especially in the luxury segment. In the case of Golf Course Road, since 2018, only DLF Crest and DLF Camellias have been completed, while the inventory in these projects is limited.

Since 2021, the demand has been growing at a rapid pace, especially in the luxury and ultra-luxury segment, whereas the supply hasn’t been able to cope-up. Also, the ready-to-move inventory is limited, and the new supply launched post-2020 will only be completed by 2024 or 2025, considering a standard time of 5 years for construction completion.

“With such a significant demand-supply gap, and the rapid hiring during Covid-19, especially in the tech and corporate sector in Gurugram, demand in luxury ready-to-move properties is at an all-time high at least in the last five years,” said Jasuja.

Data shared by property consulting firm Liasas Foras also shows that out of 1,47,000 unsold properties in Delhi NCR, at least 60 per cent are stalled, most of which are in Noida and Greater Noida. “Only 40 per cent of the inventory is marketable, which is why builders have an edge when it comes to influencing property prices. Had the supply and demand been in tandem, prices would not have increased at this pace.

Golf course road commands a premium because of the brand value

The majority of Golf Course Road is dominated by DLF, which has focussed on building luxury and ultra-luxury condos. DLF is a brand in itself, which is why it commands a premium. “In such micro-markets, it is always the developer’s reputation and the final product delivered and returns assured that lure investors and buyers. Arbour was completely sold purely on the brand play,” said Chopra.

Moreover, Gurugram has emerged as India’s newest hub for corporates to establish their headquarters, and it has, attracted millennials to Ultra High Net Worth Individuals (UHNIs) from across India and the world over. It is now also home to a large expat community that values the quality of life in a gated and safe community over everything else.

“With a vibrant culture, world-class cuisine, and a lifestyle that allows to ‘live, work, and play’ – all in a destination within a destination, is DLF5 on Golf Course Road. A mixed-use neighbourhood that brings together residences, state-of-the-art offices, world-class dining, shopping, and recreational avenues, and one of Asia’s finest golf clubs, the DLF Golf and Country Club, makes DLF5 one of the aspirational urban neighbourhoods in the city, popular among locals and foreign investors alike, as a burgeoning market,” said Aakash Ohri, Group Executive Director & Chief Business Officer, DLF.

The Golf Course view in Gurugram is equivalent to the Marine Drive of Mumbai

In every city, the location, view and quality of life drive up a property’s price. “In Mumbai, properties that face Marine Drive command the highest premium, in Delhi properties in and around South Delhi that are surrounded by lush, green spaces and are gated colonies command a premium. Similarly, in Gurugram, you have the Golf Course in front and the Arravalis at the back, and people are willing to a premium for both,” said Kapoor.

The condo life is so much in demand that people are selling their family homes in Delhi and moving to these luxury complexes. “We sold our house in Saket, and decided to live on rent in DLF’S Belair because of the amenities it has to offer. We saw other properties too like Nirvana, Park Place, Sahara but none seemed to offer the well-maintained clubhouse life that DLF does. Sure you pay a premium here, but you are not worried about security, hygeine or shoddy quality,” said Delhi-based lawyer Jyotsna Sharma.

For Sharma, the move to Gurugram is also an upgrade in lifestyle. Everything she needs – groceries, gym, tennis, movie nights, birthday hosting halls, swimming lessons for the child- are within an arm’s reach, without her having to leave the premises of her apartment complex. And this is the game DLF has capitalised on as more millennials leave the city life for the condo way of life.

Return on investment

Golf Course Road has more than delivered for those looking for a bang for their buck. NRI investments in DLF currently stand at 12-14 per cent, most of which are from the UAE, Singapore, the US and the UK.

For example, a 4,000 square feet builder floor in Delhi’s posh Panchsheel Park or Hauz Khas Enclave, which costs anywhere between Rs 18-22 crore, has hardly appreciated in the last three years. In fact, prices have more or less remained stagnant. But a similar-sized apartment has seen anywhere between 25-60 per cent escalation in price on Golf Course Road.

Golf Course Road is leading the market even in terms of rental yield. A 4,200 square feet newly constructed 4 BHK in Panchsheel Park North fetches a rent of Rs 3.5-4 lakh, while in some gated colonies like Magnolias and Aralias, it is upwards of Rs 4 lakh.

Wellness and safety in gated communities is the theme post Pandemic

“Today, DLF Golf Links residences on Golf Course Road command some of the highest rental yields in the luxury and super-luxury segment in the country, and a record capital appreciation also. There is a steep rise in demand for rentals from regional expatriate residents, businessmen and CXOs based in Delhi NCR, and even owners of these properties looking at moving and upgrading from private bungalows to high-rise condominiums. While there has been a rise in overall demand for rental, for properties on the Golf Course Road, for super-luxury residences – The Aralias and The Magnolias, at DLF5 Golf Links, there has been an upsurge in both rentals and re-trade prices,” said Ohri.

Meanwhile, increasing land prices in NCR are expected to further shoot the capital values for plotted developments and luxury apartments. However, any such price hike is not expected to negatively impact demand as the target segment’s buying capacity has improved considerably, shows research by Shashwat Srivastava, assistant manager of research and consulting at Sevills India.

“Delhi-NCR had been witnessing an increase in demand for premium homes even before Covid-19 struck. The pandemic has made ‘Wellness and safety’ a key purchase consideration. This has further increased the traction in premium housing which is likely to continue in 2023,” noted Srivastava.

Not only residential, but the corridor also boasts of some of the prime office buildings in NCR, like Hines Horizon Centre, that command the highest office rentals in NCR. By virtue of its location and specifications, the building today commands rentals in the range of Rs 150–250 per sq ft.

The demonetisation factor

After demonetisation, Delhi’s real estate market was hit severely. Funding dried up, and sales volumes were at an all-time low Property deals in the unorganised segment, known as the secondary market, depend on unaccounted cash transactions because circle rates (minimum government rate at which a property is registered) in Delhi and in some parts of NCR are far lower than the market prices.

After black money was wiped out, projects took a massive hit. It was only after the pandemic that sales really revived, and investors returned to the market.

“Prices saw maximum dip post-demonetisation. And the growth was slow post that, because investor participation was low. This market is largerly dependent on investors. And now this 40 per cent growth in property prices is used a tag line to attract more investors. But such inflated prices are not sustainable because rental yield in Delhi NCR is only 2 per cent,” said Kapoor.

Is Dwarka Expressway the next Golf Course Road?

Data shared by Liasas Foras on primary markets (where direct projects by builders are considered, and not secondary sales) shows that, on average, the maximum price appreciation has been witnessed in Dwarka Expressway.